Are you looking for guidelines that will walk you through how to file annual returns in Nigeria with CAC? As a business owner, it is essential to give an account to the Corporate Affairs Commission about your yearly financial statement.

People are often confused about the whole process because CAC has made a lot of changes to its database recently.

This guide will walk you through the requirements and when to file annual returns for Business Names, Companies and Incorporated trustees with CAC.

You will also discover the cost and the respective penalties involved for filing late.

What is CAC Annual Returns?

CAC Annual Return is a return that contains a form regarding the matters relating to the organization by the provisions of the Companies and Allied Matters Act (CAMA 2020).

Annual return is a financial statement that accounts for the status of a business regarding its stated business activities which must be paid for each entity registered with CAC

It is a mandatory requirement for every business name, private limited company, or incorporated trustee in Nigeria and is essential, as the name implies, to be done at least once every year to the Corporate Affairs Commission (CAC).

Filing the annual return helps to simply keep the CAC updated or informed that such a company or business is still active and operating with its stated business activities.

If neglected, it could result in your business losing out on access to grants, loans, contracts, and many others

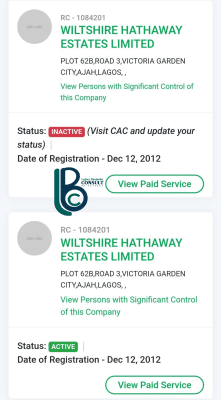

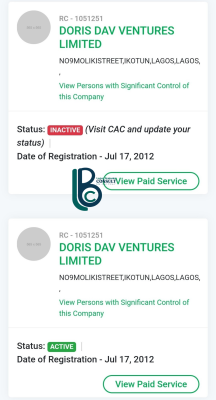

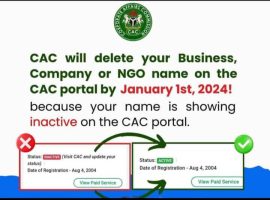

Below is the evidence of filing AR for two companies Wiltshire Hathaway Estates Limited and Doris Dav Ventures Limited

The filing was done at our consulting agency (Legacy Benjamin Consult)

As soon as your Annual Return is filed, your business status shows ACTIVE which means the business is still functioning, but when it is not filed it shows INACTIVE

In summary, Annual Return is what gives you good standing before the government and most especially before CAC.

When To File Annual Returns

According to CAC, an Annual Return must be made every calendar year. New business names may not file their return within the first 18 months of their incorporation, while for older companies, the annual return is due no later than 42 days after its yearly general meeting.

It is important to understand that the CAC calendar year starts on June 30th, meaning; for business names, you must have filed your returns between January and June of every year anything outside this is late.

For example, If your business name was registered on the 1st of January 2022, you will file your first annual returns after 18 months which is from the 1st of July 2023. (Note that this is only applicable for the first 18 months of your business incorporation, subsequent filing will be every year before June 30th)

For companies and Incorporated trustees, the period to file the annual return is between July and December. Anything outside this period is late

How To File CAC Annual Returns in Nigeria

Before we proceed with how to file a yearly Return in Nigeria, below are some important facts you should understand first, hence People usually get confused that paying for an annual return is the same as paying for a Tax

- Annual Return is not Tax and has nothing to do with Tax

- Annual Return is an embodiment of the Corporate Affairs Commission while Tax is with FIRS (Federal Inland Revenue Service) for companies and state Internal Revenue Service for Business names

Requirements For Filling CAC Annual Returns Online

Below a procedural requirements to aid with the filing of yearly returns for Business names, companies and Trustees.

CAC does not make provision for the general public to carry out this activity. Only Accredited agents or experts should file annual returns.

For Business Names

Step 1.

Firstly, request and get the Status report document from the proprietor of the business you want to file an annual return. In the case of a lost status document, it can be downloaded again on the CAC portal (charges apply).

Step 2.

Login to the CAC Post Incorporation Portal and fill in your accredited login details

Step 3.

Search for the business using the business name or number you want to file annual returns

Step 4.

Click on the Annual returns column and fill out the form with the required details (ensure everything is correct)

The Annual Return form should be signed by the proprietors of that company/business, the director, and the secretary. Once the form is filled you can submit it online and wait for approval

Step 5.

Proceed and make payment with the Annual Return fee to the authorized bank on Remit and remember to keep your receipt as evidence of payment

You will be notified via E-mail from CAC if our payment is accepted

For Companies

Below is how you can file Annual returns in Nigeria for companies with an accredited account.

Step 1.

Prepare the Statement of Affairs or Audited Statement of Accounts of your Company. (You need the service of a licensed practising chartered accountant for this)

Step 2.

Proceed and get the Annual returns form

Step 3.

Fill out the form properly and affix your signature and passport

Step 4.

Affix the Company’s Statement of Affairs or Audited Statement of Accounts duly signed by the Director and Company’s Secretary.

Step 5.

Submit the completed form for verification and approval and pay the required Annual Return Fee to the authorized bank

Keep your receipt as evidence of payment and wait for an update from CAC

- Read Also: NGO Registration Checklist

For Incorporated Trustee

The procedure to file annual returns for an Incorporated Trustee is not far different from that of a company.

Annual returns must be filed between the 30th of June and the 31st of December every year other than the year of Incorporation.

On April 1st 2024 (the deadline has been extended), CAC will start the full application of sanctions to companies that have failed to comply with the provision of the law of filing annual returns when due.

Cost to File CAC Annual Returns for Business Name, Company & NGO (2025)

The current cost to file Annual Return for Business names as of June 2024 is ₦3,000 and the penalty for not filing is ₦5,000. This makes it a total of ₦8,000 per year (if you file late)

On the other hand, Annual Returns for Limited Liability Companies and Incorporated Trustees cost about ₦5,000 and the penalty for not filing is ₦5,000 making a total of ₦10,000 per year (if you file late)

For a Limited Partnership, the yearly payment is ₦5,000 and the penalty for late filing is ₦10,000 (total ₦15,000

Public Companies will pay ₦10,000 yearly and late filing is ₦25,000 (total ₦35,000)

Penalty For Not Filing Annual Returns in Nigeria

If you fail to file your Annual Returns as the law demands in Section 425 of Companies and Allied Matters (CAMA) 2020. The provision states that the company and every director or officer are liable to a penalty that is at the discretion of the commission.

Aside from the penalty fees, failure to file Annual Returns for a consecutive period of 8-10 years is aground for striking the name of the company of the company’s register with a belief that the company in question is not in operation.

In most cases, the commission relies on one primary criterion: the failure to file Annual Returns in an indication that the company is dormant.

- Read Also: Benefits of EFCC SCUML Certificate

What Happens When Your Company Has Been Delisted From CAC Register?

Once a company is delisted for failure to file Annual Returns, anybody aggrieved by the striking off of the name of the company may apply to the court.

This court application must be done at any time before the expiration of 20 years from the publication of the notice of the removal.

The person will make a petition to the court and order for restoration of the company to register and if the court is satisfied that the company was still running business activities at the time of the strike-off the court may order the name of that company to be restored to the CAC record register.

A formal application can also be written in the form of a letter addressed to the Registrar General (RG) of the Corporate Affairs Commission, appealing as well as stating why the Annual Return is not filed as of when due.

In addition, to the written application, receipt of all payable dues (total fees of years of unfiled Annual Return), and updated records of the company or entity must be attached.

If the application is successful, a relisting certificate will be reissued to the company to that effect.

- Read Also: Best Trademark Accredited Agents

Who Should File CAC Annual Returns?

Annual Returns are to be filed by CAC Agents who have reasonable experience with the Corporate Commission. Others eligible to file could be Lawyers, Chattered accountants and legal practitioners

As a business owner, I understand the stress that could be involved in getting someone to help file your returns.

Legacy Benjamin Consult will help you take charge of all your corporate needs.

For seamless CAC registrations, Post Incorporations such as Annual returns filing,

WhatsApp Legacy Benjamin Consult

Importance of Paying Annual Returns

Below are some of the massive benefits and importance of filing Annual Returns with CAC in Nigeria.

1. ✅ It helps the company or entity give notice to the Commission of the entity’s continued existence, further to which the entity’s name is retained on the register kept by the commission.

2. ✅ Filing Annual Returns saves time, especially in a situation where a business or company require a post-incorporation service and must obtain a document or process any other application at the CAC office

3. ✅ An up-to-date filing is usually one of the requirements for most contract bids in public or private establishments. Again, an entity desirous of meeting these requirements must ensure that its records are updated as well

4. ✅ Failure to file yearly returns on time will result in a penalty which you could pay more than the initial amount

5. ✅ The status of your business can lose its registration status from the CAC database if not filed.

Checkout: Why You Must Register Your Company With CAC

Conclusion:

In conclusion, I hope this article has provided vast knowledge regarding the understanding, need and cost to pay your CAC annual returns as a business name, company or NGO and the dangers of failing to comply

If you have any questions regarding your company status or good standing, feel free to comment below

Legacy Benjamin is a serial SEO content writer with a half-decade of experience in the field of blogging. He is also a skilled business consultant, providing valuable insights to companies and individuals seeking growth and success. His expertise lies in crafting compelling and engaging content that captivates audiences and drives business results. For business deals, contact him

This publication is really helpful to we business owners and those who want to register their business.

I know legacy Benjamin personally, He handle all CAC registrations, SCUML.

Thanks for this one Bro.

I am an agent but this was still very useful to me. Thanks for the detailed quality content.

It is really educative. thank

Thanks bro… I appreciate this one.

Thanks for your comment. Pls send me a DM on Whatsapp 08066108299

Thanks Ben, you have done a good work on this subject, but what is the procedure for filing annual returns online for business that had registered manually before the online platform came. I have checked their Post-incorporation portal and they said in their office that it is now active, but no no way to either register/create an account or fill the form.

This is enlightening, thank you sir,

1:please for a company that defaulted in paying for 3 years how much should be the payment, 15k or 10k per year?,

2:Which form should be used for a small company, I saw a ten-pages form in CAC site and another two-pages form as in your post.

3: How and where will the fee be made, (bank details) before submitting or after,? After approval? How will evidence of payment be attached if it is after?.

4:How will I know if it is approved?. How long will it take for CAC to approve it?

5:Any certificate or a form of acknowledgement from them?

Yes I do, send me a message via WhatsApp

Good day, do you assist with filing of business name annual returns?

Thanks for your comment Olajumoke. You can only file annual returns manually for now

I am grateful for this. you have done a great job by enlightening me on the procedure to file annual returns. can I file this manually or electronically?

secondly, how much do you charge for a business name and small company annual return filing?