Silk Loan App has been one of the most advertised loan apps in Nigeria in recent times. Similarly to Okash and Easy Credit and Renmoney Loans, the Silk Loan App offers a convenient way to apply and borrow money online with little or no interest rate.

While borrowing money may be a quick way to source funds to meet urgent financial needs, It is very important to have an idea of the kind of loan you are collecting, the terms and conditions, the interest rate and duration of payment.

Borrowing generally is not a bad thing, so long as you have a structure to repay the money borrowed. People borrow for so many reasons. Whether for investing, starting a business or meeting short term financial obligations, this can be termed as good debt.

The worst thing you can do is borrowing money for consumption, such as buying things you do not need or spending lavishly to oppress people online.

This creates an illusion that you have made it, meanwhile you are living off of bad debt, which also puts a restriction on your financial growth due to poor financial management.

Silk Loan App adverts have been popping up on my phone each time I try to watch a YouTube video. After a quick thought, I decided to investigate this loan app and find out what they bring to the table.

About Silk Loan App

Silk Loan is a reputable financial partner dedicated to providing easily accessible and adaptable lending options.

The SilkLoan App is founded by Ayo Johnson, a Nigerian entrepreneur, studied in both the United States and Spain, where he developed a passion for financial technology.

After returning to Africa to launch SilkLoan, he aims to empower individuals with accessible financial solutions.

SilkLoan is available in the following countries;

- Nigeria

- Ghana

- Peru

- Tanzania

- Uganda

- Argentina

- Ecuador

- Dominican Republic

- Guatemala

How Silk Loan App Work

The SilkLoan app works by providing daily loans every day of the week from Monday to Sunday. The whole process is done via the Loan app

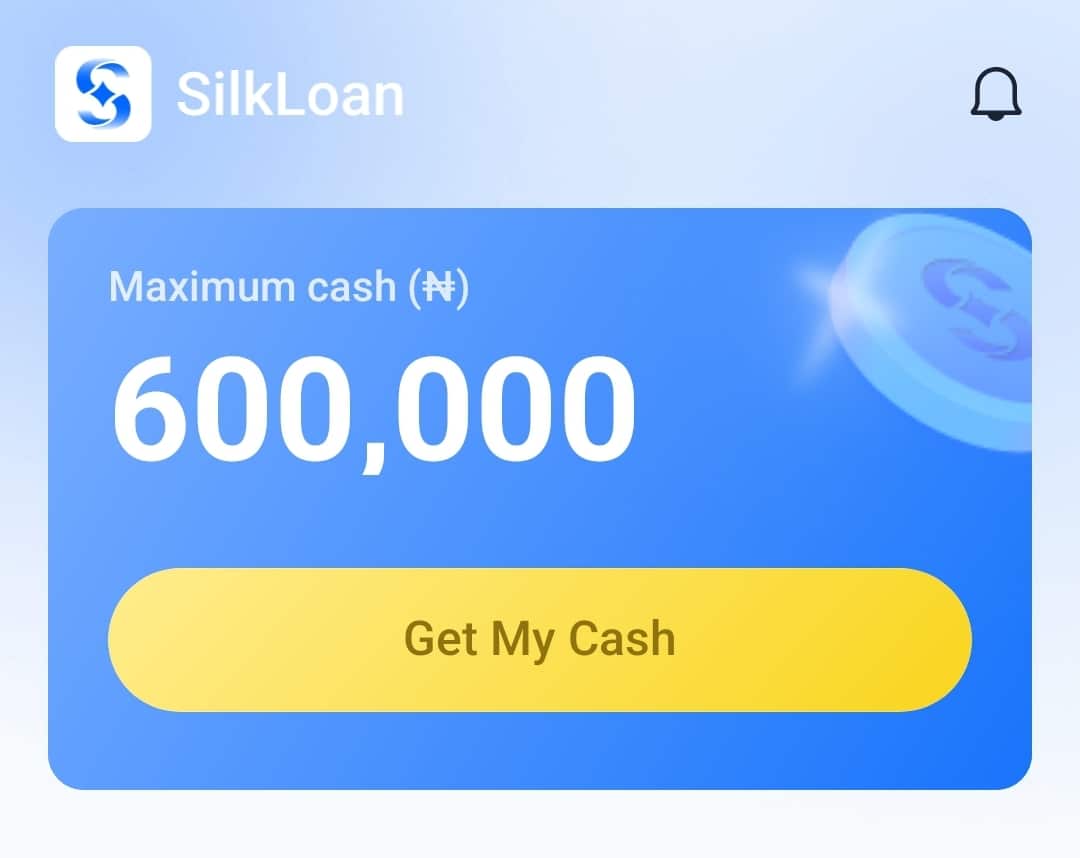

You can get as high as ₦600,000 loan amount which will be subject for approval and disbursement within 1 hour

The repayment period for this loan is within 90 to 360 days

Requirements to Apply for Silk Loan

Silk Loan offers one of the easy requirements. All you need is;

- Phone number

- BVN

- Your Address

- ID

- You must be 18+

The company will also ask you some few questions to verify your identity and authentication.

How to Apply for Silk Loan Online from App 2025

Follow this simply steps to request for Silkloan

1. Download the silk loan app on Google Play Store

2. Open the app and set up your bank details

3. Request for loan

4. In the process of requesting for loan, the app you will ask you to provide details about

- The loan amount you need

- How you would like to repay the loan

- Your monthly income

- Emergency contact Info. (These are people that will be contacted should you fail to pay up your loan)

SilkLoan uses data from your phone as well as other sources to make a lending decision. To increase your chances of approval, please make sure to save the data on your phone, pay up your loans from other apps or lenders, and correctly input your account details.

Silk Loan Interest Rate

The interest rate annually is between 12% to 36.5% depending on the amount borrowed and the duration of payment.

Let’s say you borrow ₦12,000 at a daily interest rate of 0.1%, with repayment every 30 days for a total of 6 periods:

₦12,000 x 0.1% x 30 x 6 = ₦2,160

For a period of 180 days

₦12,000 + ₦2,160 = ₦14,160 (Total repayment)

Instalmental payment

₦14,160 / 6 = ₦2,360

That means you will be paying ₦2,360 for each month up till the 6th time

So in summary, If you borrow ₦12,000 you will repay ₦14,160 in 180 days (But to be paid 6 times which is every 30 days)

Does Silk Loan Require Collateral

No. Silkloan is one of the few loan apps in Nigeria that offers loans without collateral

How to Repay SilkLoan

- Open Silk Loan on your phone

- Click the Repay

- Confirm that all details are correct and press “Repay now”

- Choose your Repayment method and press “Repay now”

- Complete your Repayment

In case you try paying back your loan but due to mistake, and you overpay, the app will reconcile your loan status and excess funds will be reversed to your repayment bank account within 15 days.

SilkLoan Contact

If you have any concerns, you can chat or mail their customer care via

Is Silk Loan App Legit?

From my intensive research on this Loan app, I could not get any data of it being registered with the Corporate Affairs Commission which is a key Federal Government Agency saddled with the responsibility of regulating the formation, operation, licensing and certification of businesses in Nigeria and financial institutions like this.

Secondary, I couldn’t ascertain if Silk Loan is licensed with the Central bank of Nigeria to operate as a digital financial institution to issue loans.

There are my two major concerns with this loan app and as someone who has never borrowed money from any loan app before, I really find nothing interesting.

Though, this is not to discourage you from acquiring loan from this app if you really need it. There are also some good feedbacks and reviews on Google Play Store, where the loan app has also recorded over 1 million downloads.

So the decision to borrow money from this loan App is yours to make, and if you eventually do, ensure to repay on time and don’t be a bad debtor

Conclusion

Silk Loan App offers one of the easiest loans without collateral. You can get as low as ₦2,000 and as high as ₦600,000 loan with low interest rate and a long payback time.

While there may be concerns of the company’s legitimacy and their license to operate, let us know in the comment section your experience with this loan app

Legacy Benjamin is a serial SEO content writer with a half-decade of experience in the field of blogging. He is also a skilled business consultant, providing valuable insights to companies and individuals seeking growth and success. His expertise lies in crafting compelling and engaging content that captivates audiences and drives business results. For business deals, contact him

Hello, I hope you’re doing well. I’ve recently come across legacytips.com and would love to contribute a guest post. Could you please share the details for collaboration? Thank you, looking forward to your reply.

𝑖𝑠 𝑔𝑜𝑜𝑑 𝑖𝑓 𝑖𝑠 𝑙𝑜𝑤 𝑖𝑛𝑡𝑒𝑟𝑒𝑠𝑡