This business article is a guide to help you with Prospa Business Account Requirements

Are you a small-scale entrepreneur in Nigeria and looking for a way to up your business? It is without doubt that small-scale enterprises contribute a large percentage to the Nigerian economy.

However, they often face challenges in accessing finance. Prospa is a digital banking platform that provides business loans and accounts to SMEs in Nigeria. This makes it easier for them to manage their finances, send and receive money, and access business loans.

Just take a look at a world where your business has the financial resources it needs to thrive. Also, your business can easily access loans to expand it and create jobs. This is the world that Prospa is working to create.

With Prospa, SMEs can finally get the financial support they need to reach their full potential. Prospa is making it easier for SMEs to grow and succeed, and this is good news for the Nigerian economy as a whole.

In this article, we will highlight to you the requirements to get a Prospa business account in the country.

About Prospa

Prospa is a digital banking platform that provides business loans and accounts to small and medium-sized enterprises (SMEs) in Nigeria. It was founded in 2019 by three young Nigerian entrepreneurs and technocrats.

Prospa’s mission is to support African entrepreneurs and businesses by building an operating system for financial prosperity. The company offers a range of products and services to help SMEs manage their finances, grow their businesses, and achieve their financial goals.

Prospa’s business account is a one-stop shop for SMEs to manage their finances. It offers features such as:

- Free online and mobile banking

- Easy money transfers

- Bill payments

- Payroll processing

- Access to business loans

Prospa also offers a range of business loans to help SMEs grow their businesses. These loans are tailored to the specific needs of SMEs, and they are designed to be easy to apply for and receive.

Prospa is a leading provider of financial services to SMEs in Nigeria. The company has over 100,000 customers and has disbursed over $100 million in loans. Prospa is backed by leading investors such as Y Combinator, Partech Africa, and TLcom Capital.

Is Prospa Legit?

Yes, Prospa is a legitimate company. It is a digital banking platform that provides business loans and accounts to small and medium-sized enterprises (SMEs) in Nigeria.

Prospa is registered with the Corporate Affairs Commission (CAC) of Nigeria and has a valid operating license from the Central Bank of Nigeria (CBN).

Who Owns Prospa?

Many people have been asking this question in order to determine the safety of using this app. Let’s clear the air on this.

Prospa is owned by its founders, Rodney (Akinwunmi) Jackson-Cole, Chioma Ugo, and Frederik Obasi The founders have a combined experience of over 20 years in the financial services industry.

Jackson-Cole is the CEO of Prospa. He is a serial entrepreneur and has founded several successful businesses in the tech and media industries.

Chioma Ugo is the current Head of Growth and co-founder of Prospa. She previously worked at the UK Parliament as a Parliamentary Advisor on Digital Outreach.

She is also the Chief Operating Officer of Prospa. She has over 10 years of experience in the financial service industry.

Obasi is the Chief Technology Officer of Prospa. He is a software engineer with over 10 years of experience in the tech industry.

The founders of Prospa are passionate about helping SMEs grow and succeed. They believe that SMEs are the key to driving economic growth and development in Nigeria.

Prospa Business Account Requirements in Nigeria

Starting a business in Nigeria is an exciting and rewarding experience. But it can also be a bit daunting, especially when it comes to managing your finances.

That’s where Prospa comes in. With their business account, you can easily manage your finances, send and receive money, and access business loans.

To open a Prospa business account, you will need to meet the following requirements:

1. Business registration:

Your business is your baby, and you’ve taken the important step of registering it with the CAC. This shows that you’re serious about your business and that you’re committed to making it a success.

2. Tax identification number (TIN)

Your TIN is like your business’s fingerprint. It’s a unique identifier that helps the government track your business activity and ensure that you’re paying your taxes fairly.

3. Bank verification number (BVN):

Your BVN is your personal financial fingerprint. It’s a unique identifier that helps banks and other financial institutions verify your identity and prevent fraud.

4. Government-issued ID:

Your government-issued ID is proof that you are who you say you are. It’s also required to open a bank account in Nigeria.

5. Utility bill:

Your utility bill is proof that you have a fixed address. This is important for banks and other financial institutions to know when assessing your creditworthiness.

6. References:

References are a way for Prospa to get to know your business better and assess your creditworthiness. They’re also a way for Prospa to verify your identity and to make sure that you’re a legitimate business owner.

Once you have met all of the requirements, you can open a Prospa business account online or through the Prospa mobile app. The account opening process is quick and easy, and you can start using your account immediately.

Read Also:

How to Transfer funds to 9 Payment Service Bank

Why Open a Prospa Business Account?

There are many benefits to opening a Prospa business account, including:

1. No account opening fee: There is no fee to open a Prospa business account.

2. No minimum balance requirement: There is no minimum balance requirement to keep your Prospa business account open.

3. Free online and mobile banking: You can access your Prospa business account online and through the Prospa mobile app for free.

4. Easy money transfers: You can easily send and receive money from other Prospa business accounts and Nigerian banks.

5. Access to business loans at competitive interest rates: Prospa business account holders are eligible for business loans from Prospa at competitive interest rates.

Prospa Business Registration in Nigeria

Boss, you’ve got this!

Starting a business in Nigeria is a dream come true for many of us. But let’s be honest, the registration process can be a bit of a nightmare. That’s where Prospa comes in.

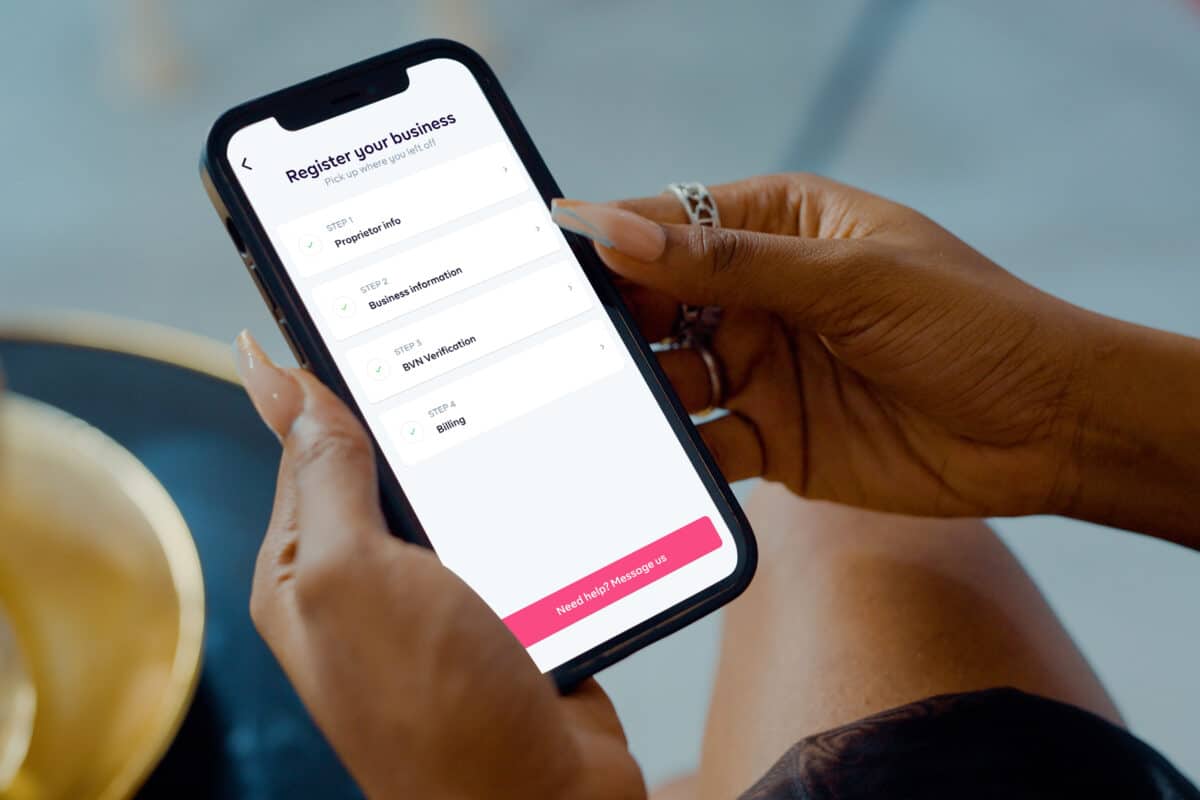

Prospa is a digital banking platform that makes it easy to register your business online in just a few simple steps.

Here’s how it works:

Head to the Prospa website and click on the “Register Your Business” button.

- Enter your business details, such as your business name, CAC registration number, and TIN.

- Enter your personal details, such as your name, email address, and phone number.

- Create a password for your Prospa business account.

- Upload the required documents, such as your Business Name Registration certificate, Certificate of Incorporation, and TIN certificate.

- Submit your application.

That’s it! Once your application has been approved, you’ll be good to go.

Prospa Business Account Minimum Balance

When it comes to business accounts, minimum balances can be a major setback. Especially for small businesses that are just starting out.

But with Prospa, you can say goodbye to minimum balances and hello to a business account that works for you.

Prospa Business Accounts have no minimum balance requirement. That means you can keep as much or as little money in your account as you need, without having to worry about fees.

So what does this mean for you? It means you can focus on running your business, instead of worrying about your bank balance.

It means you can invest in your business, without having to worry about keeping a certain amount of money in your account. And it means you can keep your personal finances separate from your business finances, without having to pay extra for the privilege.

Prospa App: How to Download it

The Prospa app is a convenient and easy way to manage your Prospa business account, send and receive money, and access business loans.

To download the Prospa app, follow these steps:

- The first step is to go to the Google Play Store or your Apple App Store.

- When you’re there, search for “Prospa”.

- Tap on the “Install” button.

- Once the app has been installed, open it and create an account.

- If you already have a Prospa business account, you can log in with your existing username and password.

The Prospa app offers a variety of features, including Free online and mobile banking, Easy money transfers, Bill payments, Payroll processing, and Access to business loans.

Also, you can also use the Prospa app to check your account balance, view your transaction history, and manage your loan payments.

The Prospa app is a valuable tool for SMEs in Nigeria. It makes it easy to manage your finances, send and receive money, and access business loans.

Read Also:

DotPay Business Account Requirements

Conclusion: Prospa Business Account Requirements

Prospa Business Accounts is what I can recommend for SMEs in Nigeria. The interesting part of it is that there’s no minimum balance requirement.

With a Prospa Business Account, the sky is the limit. So what are you waiting for? Open a Prospa Business Account today and start growing your business!

Legacy Benjamin is a serial SEO content writer with a half-decade of experience in the field of blogging. He is also a skilled business consultant, providing valuable insights to companies and individuals seeking growth and success. His expertise lies in crafting compelling and engaging content that captivates audiences and drives business results. For business deals, contact him